Two significant macro events loom large over the real estate market: interest rates and the upcoming election. Interest rates have already contributed to a cautious atmosphere, as both buyers and sellers adopt a wait-and-see approach. The uncertainty surrounding the election only adds to this hesitation, creating a “holding pattern” that could persist in the near term.

How these factors evolve will likely influence the trajectory of the market moving forward. For now, we remain in a delicate period where listing activity is slowing, and market conditions appear to be in flux. We are keeping an eye on these key indicators as we move into the quieter months of the year.

The 3Q2024 Manhattan Market Report reviews third quarter results and provides insight into the broader picture. We’ve attached the full report for your review.

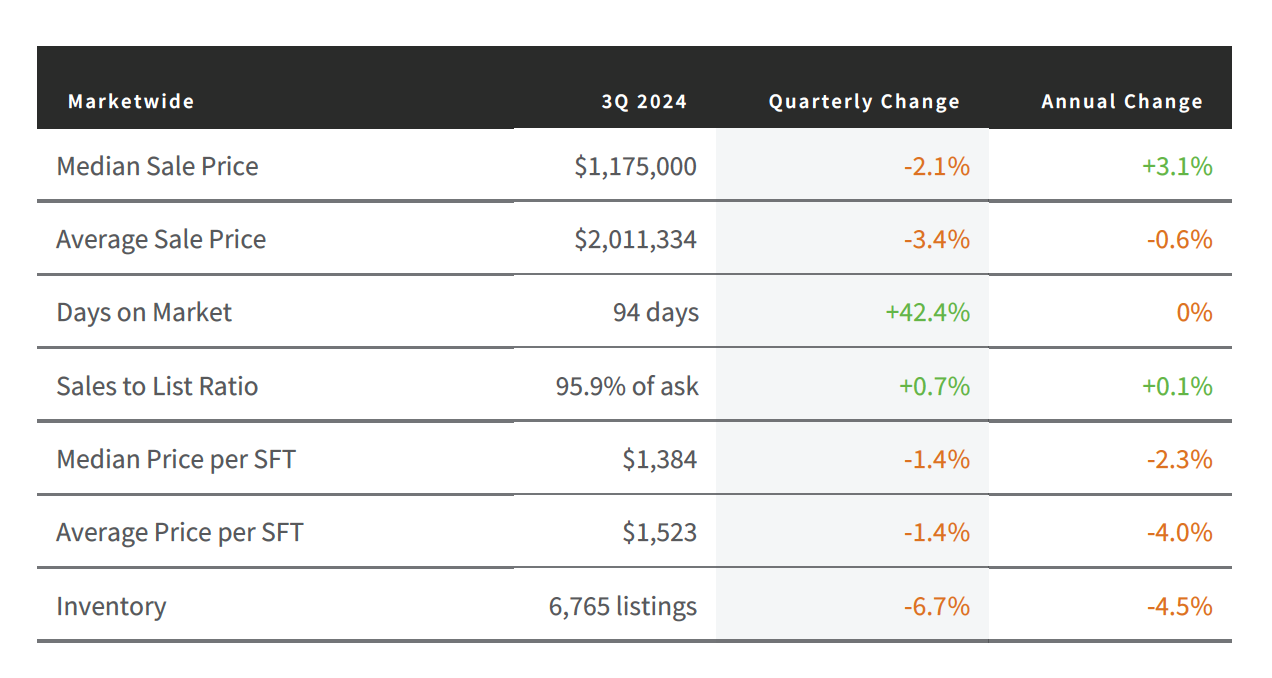

The third quarter of 2024 showed signs of growing pains in the Manhattan real estate market, even as it continues to adjust after early signs of recovery. Median prices dipped by 2.1% compared to the previous quarter, though they rose 3.1% year-over-year, indicating a certain level of resilience amidst these market shifts. Median price per square foot dropped by 1.4% quarter-over-quarter and saw a more notable annual decline of 2.3%. However, with inventory shrinking, we may see market activity pick up and prices stabilize as we navigate the fall season.

www.unbandigs.com

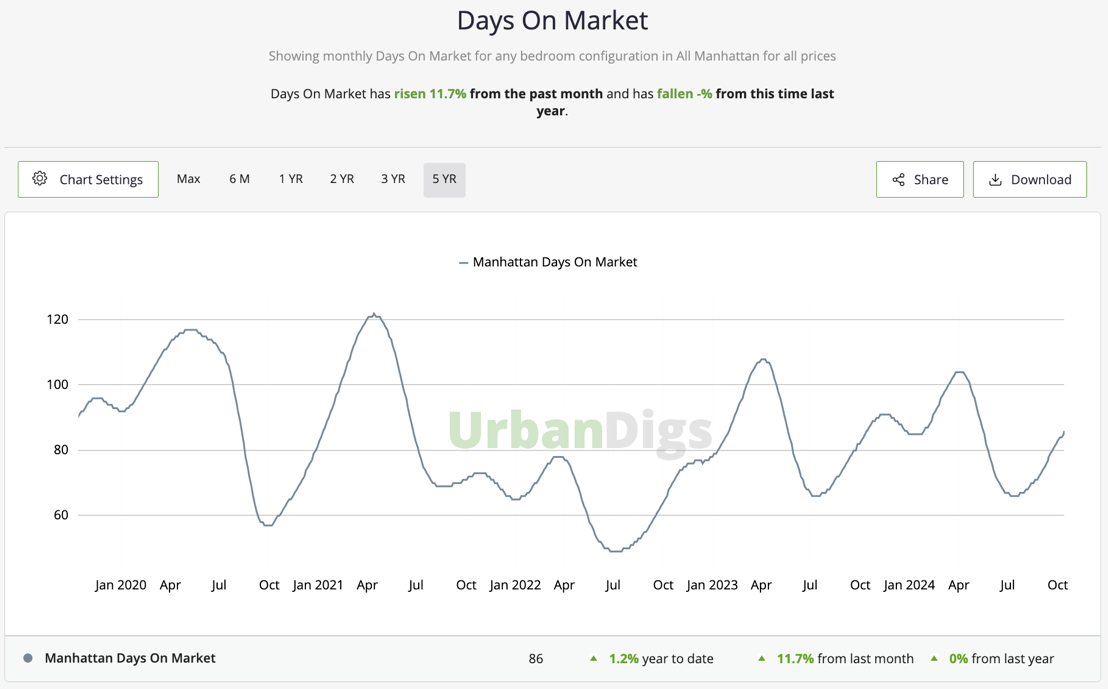

As expected during the slower summer months, properties took longer to sell in Q3. The average time on market increased by four weeks compared to the previous quarter, although it held steady year-over-year at 94 days. This reflects the usual seasonal ebb and flow of the market.

www.unbandigs.com

One positive trend was that sellers saw a better return, with the sales-to-list price ratio climbing to 95.9%. This represents a 0.7% increase from the previous quarter and a slight improvement over last year. This uptick suggests that while prices have softened, the market is finding some stability.

Fall Listing Challenges Continue

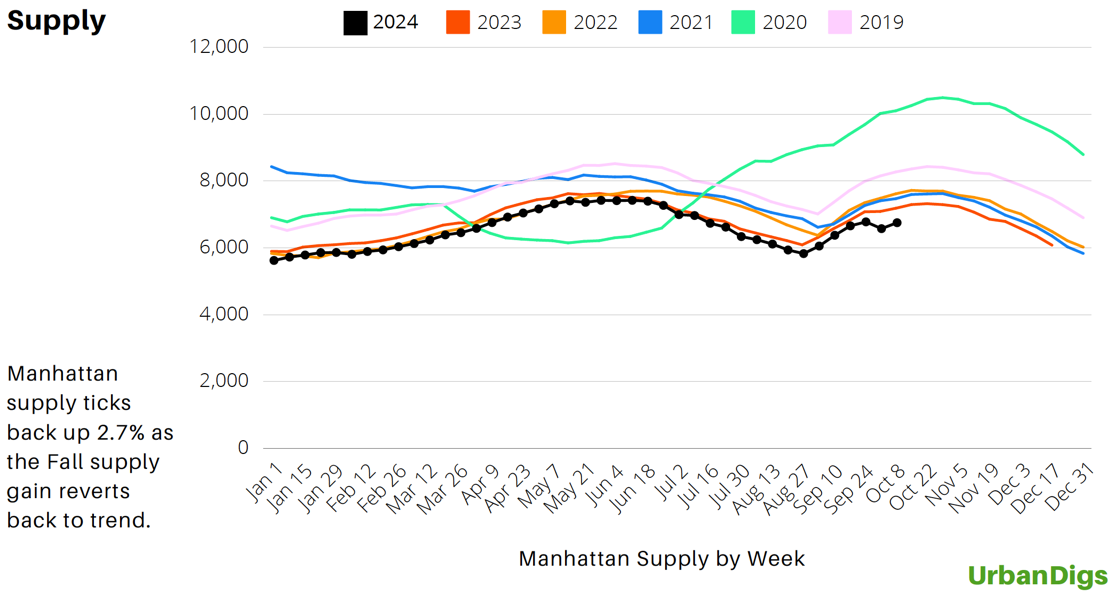

In our recent newsletter, we pointed out that the New York City real estate market is facing a challenging listing environment. As we reach the midpoint of October—the busiest month of the fall—it’s uncertain whether we’ll reach the 7,400 active listings recorded at this time last year. As of October 11th, supply sits at 6,758 active listings. With only two weeks left in the month, it’s doubtful that we’ll close the gap. November typically sees a slowdown in new listings, which could continue to impact market activity. Once into November, the listing environment is not expected to pick up until the Spring 2025 market – February / March 2025.

As we move forward, the numbers from Q3 provide a useful benchmark, however, the market’s trajectory remains tied to larger, unpredictable forces. If you have any questions, we are happy to discuss.