As summer hits its peak, we now have the latest real estate data for Manhattan’s second quarter. It’s a great time to take a step back, reflect on where we are, and understand the current leverage dynamics at play. Here’s an update on how the market is trending and strategic advice for both buyers and sellers.

Days on Market

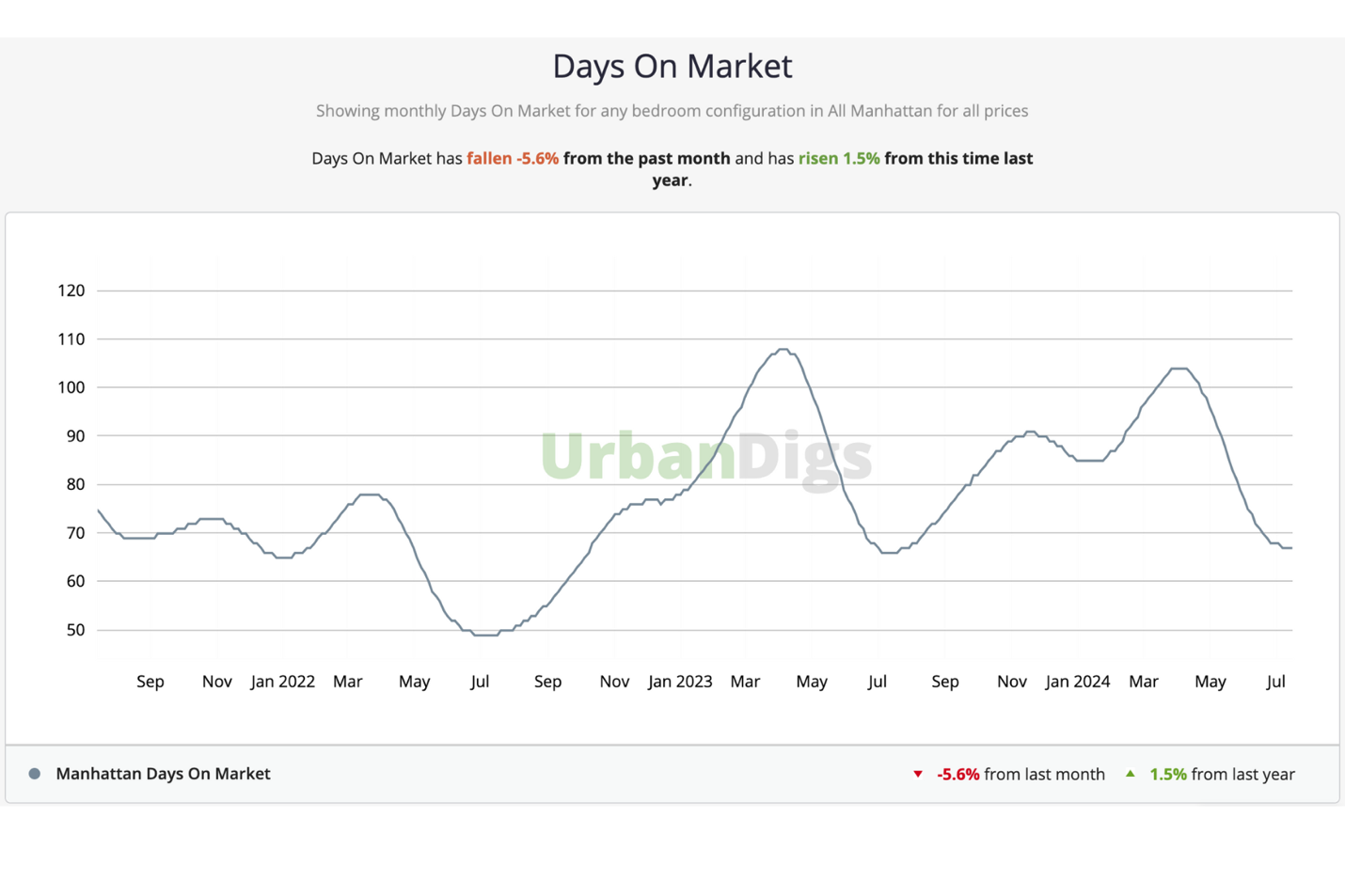

As we transition from the historically busy spring season into summer, we expect the NYC real estate market to enter it’s typical slow down during July and August. The chart below shows average days on market for listings in Manhattan and provides a clear illustration of this trend. You can see that once we hit July, days on market is expected to go up, generally meaning the market as a whole slows down.

Also important to note, days on market numbers are currently staying within 1.5% of where we were this time in 2023. This could mean this year’s trajectory from summer into fall could follow historic norms.

Another factor to remember is that the NYC market is still very fragmented. There isn’t a one-size-fits-all answer for every property, as factors like renovation status and monthly costs continue to be significant considerations for buyers.

Feel free to explore the complete Q2 market report below for a more in-depth look at how the NYC market performed overall, including a detailed breakdown by neighborhood.

Here is the link to the KWNYC 2Q2024 REPORT.

Summer Outlook

Considering the ongoing influence of national economic factors such as inflation and interest rates, alongside the upcoming fall election and its political implications, macroeconomic conditions have the potential to significantly shape our real estate market in the second half of this year. These factors also become increasingly uncertain the further into the future we project. Keeping that in mind, here’s what we suggest for sellers and buyers right now:

For Sellers

For sellers, the market is as active as it has been in months, thanks to a slight decline in rates that has reignited demand. If you’re looking to sell, consider taking aggressive pricing action sooner rather than later to capitalize on this uptick. Be mindful that contract activity historically declines an average of 13% from June to July, 7% from July to August, and 17% from August to September (data from UrbanDigs). Activity tends to pick up again after Labor Day, but new listings will also come to market, increasing competition. If you’re considering going off-market for a refresh in the fall, be aware that this year may present more uncertainty due to the upcoming election, which could slow down the market even further.

For Buyers

The current uptick in demand due to declining rates presents a potential opportunity. Although the market isn’t in panic mode, many sellers, especially those with listings over 120 days, may be highly motivated and more open to negotiation. With prices favoring buyers, this summer slow period could be a prime time to make a move. Stay informed about market conditions, know your desired property, and make well-informed decisions to take full advantage of the current climate.

We would be happy to have a deeper discussion if real estate is on your mind. Feel free to contact us anytime!