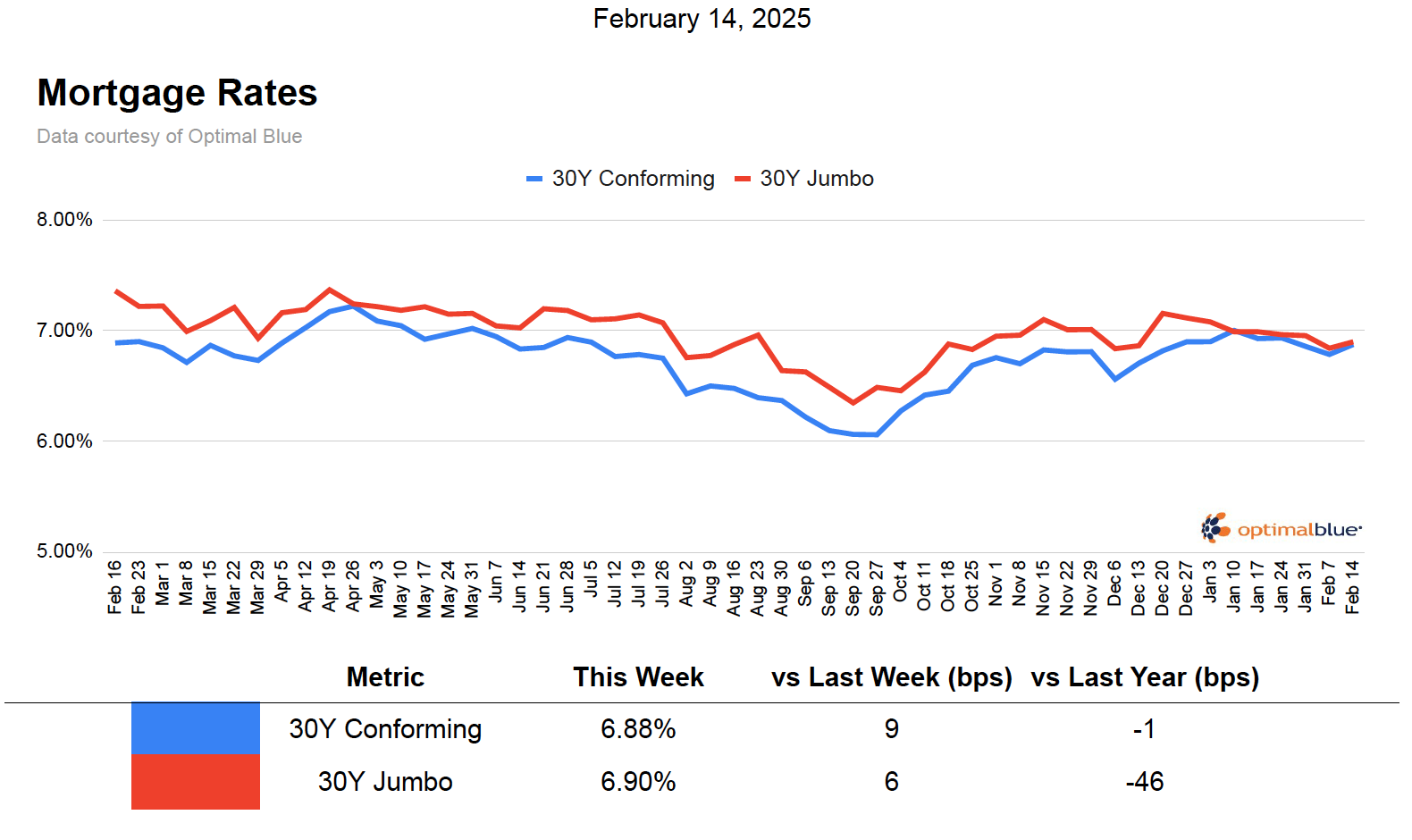

Manhattan’s real estate market ended 2024 on a high note, with deal activity picking up as buyers responded to lower mortgage rates. However, the year end had a plot twist. Mortgage rates resumed their upward trajectory, and supply plummeted, creating a tightrope walk for buyers and sellers. Early 2025 is shaping into lower supply and higher stakes.

Market Sentiment & Trends

The real estate market showed strong activity in late 2024 but faded slightly in December and January. However, February has shown signs of renewed energy as buyers re-enter the market. Interestingly, interest rates no longer seem to be a major deterrent, as many buyers have adjusted to the current financial climate.

UrbanDigs.com

Instead, the biggest challenge now is navigating a segmented market where well-priced, high-quality inventory moves quickly, while outdated or overpriced units struggle.

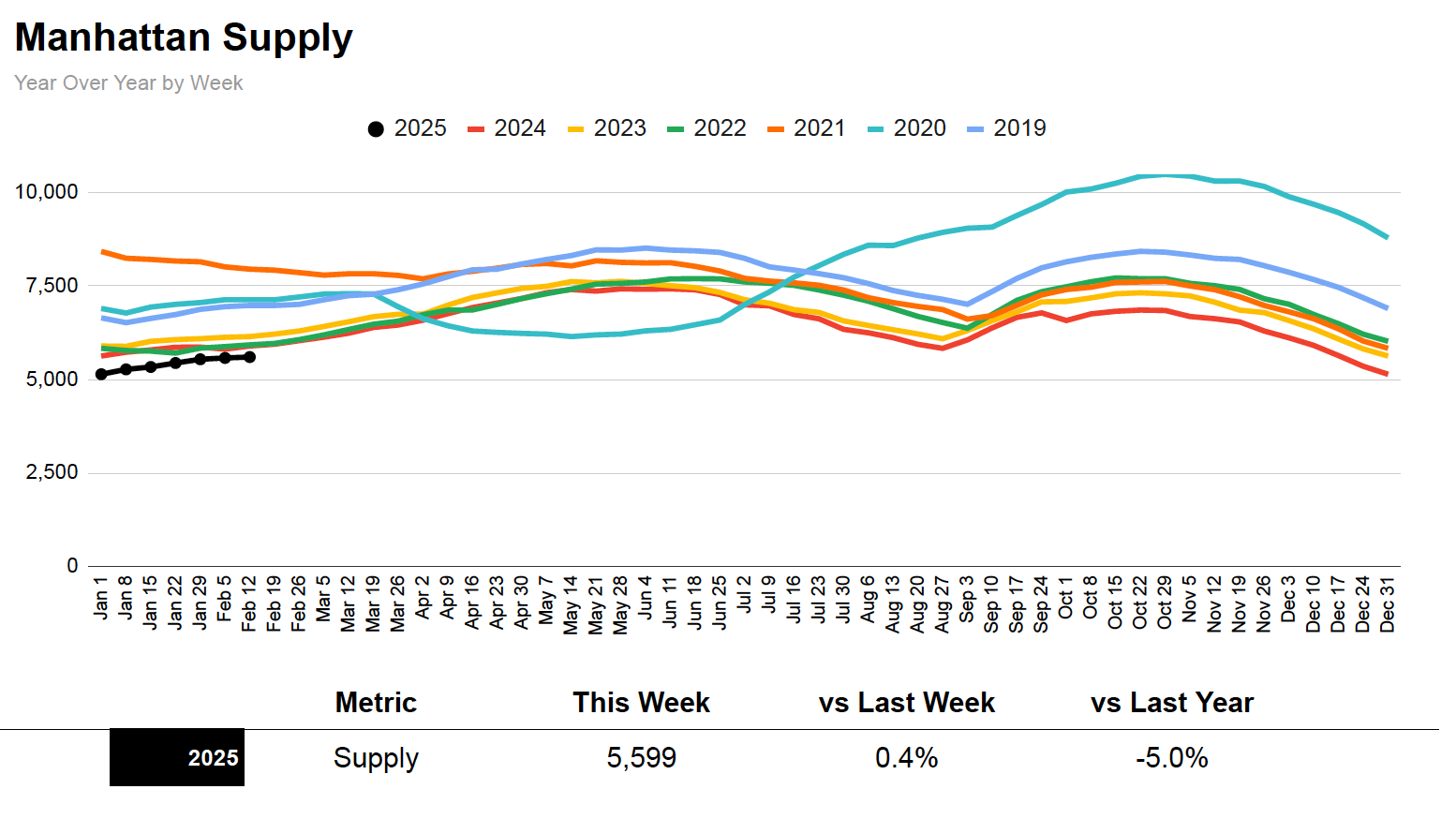

Supply Crunch

During winter, activity tends to slow down. As illustrated below, the market generally enters a lull after Thanksgiving, and by late December, it is almost at a standstill. As expected, the number of homes for sale usually drops off. The cycle restarts in late February, with supply building through the spring until it dips again into summer.

UrbanDigs.com

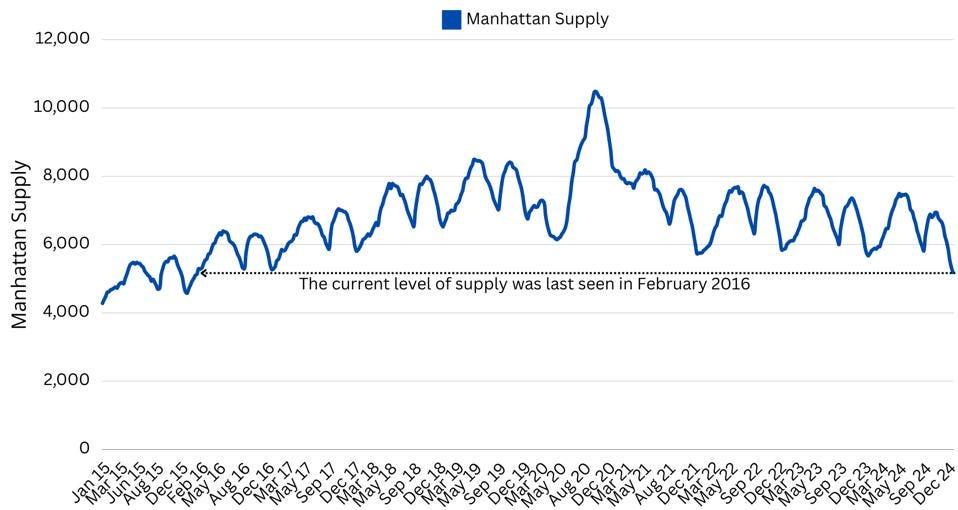

However, the active inventory of Manhattan homes dropped 17% from December 2024 to January 2025—the largest drop in over 10 years. As a result, supply has fallen to levels not seen since 2016. The trend is also noticeable across the main Manhattan neighborhoods, with all areas seeing inventory drops exceeding 15% from December into January.

Manhattan Supply, January 2015 to December 2024.

UrbanDigs.com

This trend has led to Manhattan’s active inventory falling from 6,255 units in early December to just 5,559 in mid-February. Peak spring season (end of May / June) normally has supply of 7,400 to 7,500 units. This number is being watched closely to see if supply begins to normalize.

Déjà Vu?

When supply reached these low levels in 2016, it coincided with a market surge following a prolonged recovery from the Great Recession. Tight inventory often coincides with macroeconomic uncertainty or market cycles that make sellers hesitant to list. Manhattan’s past supply levels suggest these moments are often inflection points, either launching the market into a price frenzy (2016) or holding it in a cautious standstill (2023).

Low Supply + High Rates = Price Pressures

Here’s the twist: While low supply might suggest existing sellers have the market to themselves, it’s not that simple. High interest rates and cautious, price-sensitive buyers mean overpriced properties continue to linger.

For buyers, the math isn’t easy either. With higher mortgage rates, competition for well-priced, turnkey properties is fierce. As a result, both sides feel the squeeze.

Segmented Market Performance

The Manhattan market is increasingly divided based on price point and property type:

- Luxury & New Development: High-end properties ($5M+) and well-located new developments continue to perform well, often selling with minimal price negotiations. The demand for premium properties remains strong as affluent buyers remain active.

- Mid-Range & Entry-Level: Studios and smaller apartments are facing challenges due to tighter lending practices and buyer hesitancy. This segment is seeing slower movement, and sellers may need to adjust pricing strategies accordingly.

How To Play It

If you’re buying or selling today and hope to transact before the spring season kicks off, you may need to tweak your market strategy to accomplish your goals.

Buyers:

Now isn’t the time to wait for the perfect deal. Focus on opportunities from realistic sellers, such as those that have been on the market for a while or recently had price reductions. If you’re shopping in the mid-range or entry-level market, be prepared for tighter lending conditions and make sure your financing is solid.

Sellers:

If you’ve put your property on the market or are considering listing, do a reality check. Overpricing is the easiest way to end up with a stale listing, so market pricing is essential. If your property isn’t turnkey, consider upgrades to attract attention, as the market still rewards value and instant livability.

Looking Ahead to Spring 2025

While some of the inventory drop aligns with typical seasonal patterns—winter is usually a slower time for real estate—higher mortgage rates and cautious sellers have intensified the crunch. For buyers, the challenge in early 2025 will be navigating limited options without overspending. For sellers, success will depend on meeting the market where it’s at.

For those considering buying, preparation is key. Get pre-approved, understand market conditions, and be ready to negotiate—because in Manhattan real estate, the right opportunity waits for no one.