Manhattan’s real estate market is kicking off the year with a lot to unpack. Inventory is tighter than we’ve seen in years, demand is holding strong, and economic factors like mortgage rates are still shifting. There’s plenty happening in the market to discuss, so let’s get into it!

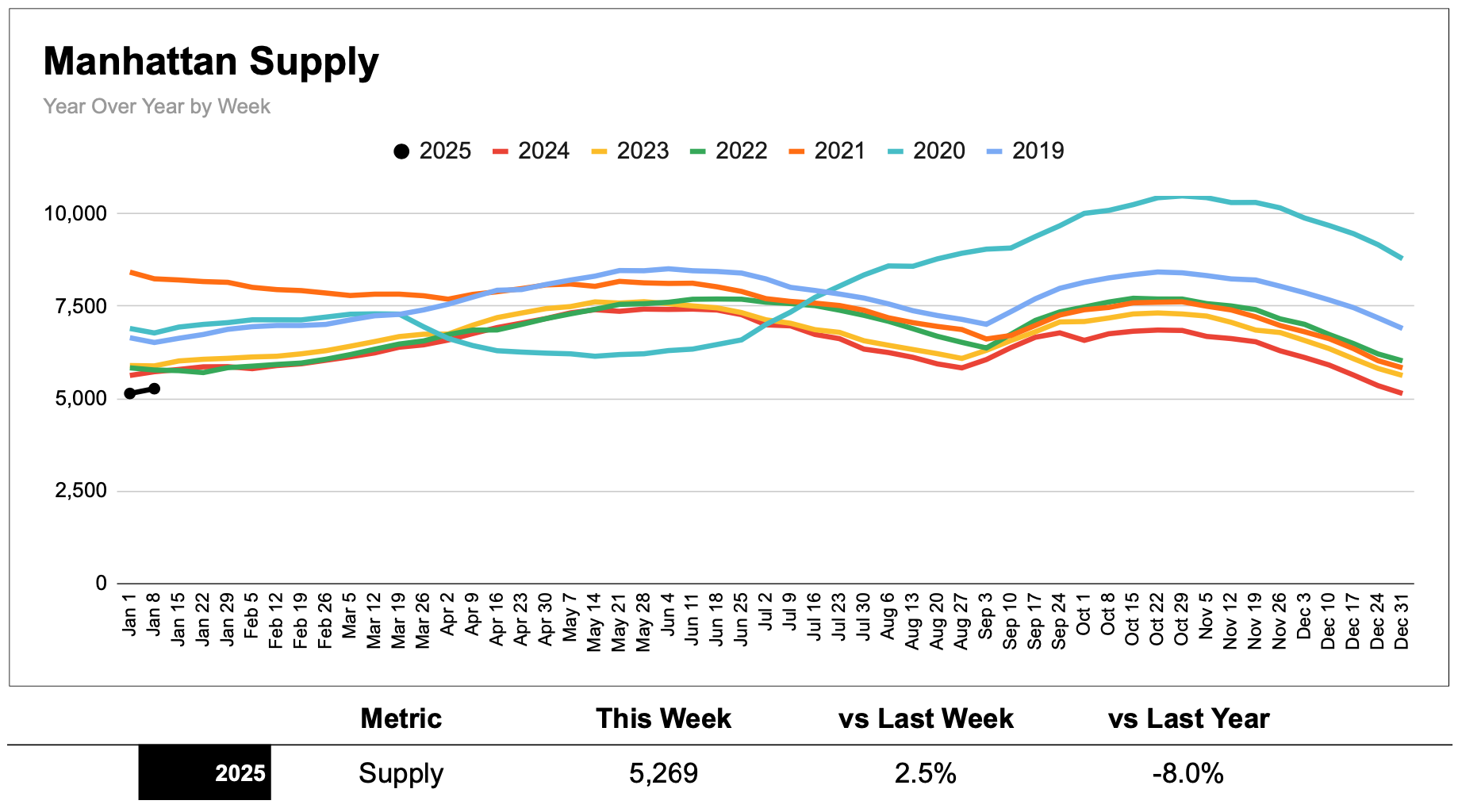

Supply Is Tighter Than Ever

The current supply in Manhattan has dropped to 5,269 units, marking a 7.4% decline compared to this time last year. Recently, inventory hit a low of 5,130 units, the tightest level since late 2016. While supply appears to have bottomed out, it’s clear we are entering 2025 with far fewer listings than in previous years.

What does this mean? Tight inventory doesn’t always equate to a seller’s market. It just as often translates into a more challenging environment for both buyers and sellers. It is too early to say but sellers are recommended to avoid overpricing their properties. Many buyers are remaining selective due to limited options and elevated rates.

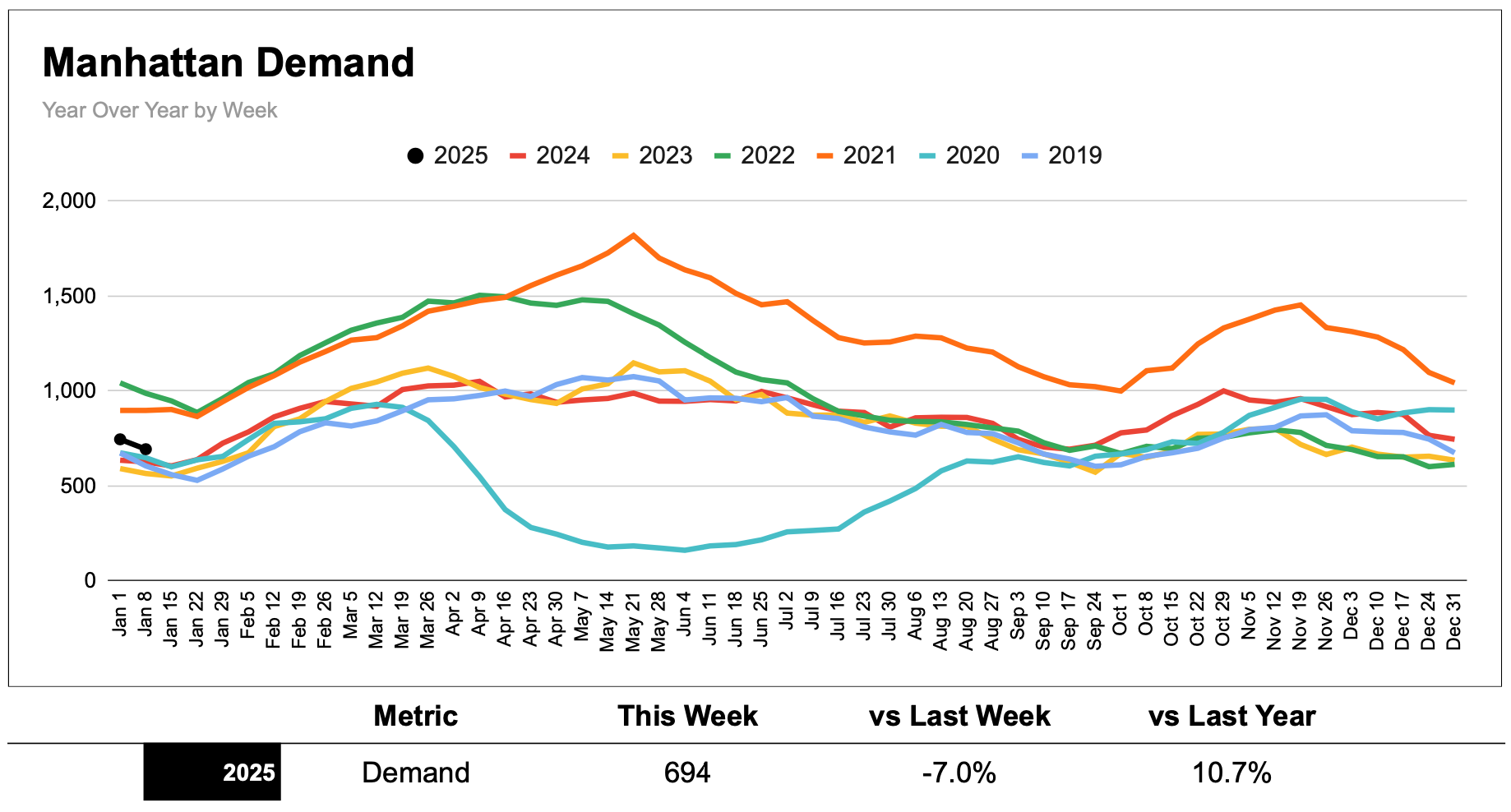

Demand Still Strong

Over the past 30 days, 694 contracts have been signed, reflecting a 13% increase from last year. While slightly down from last month, demand is expected to rise steadily as we approach the end of January. If this trend continues, we may exceed the seasonal benchmark of 767 contracts signed before February.

This growth follows a strong finish to 2024, where demand exceeded expectations despite high mortgage rates. As we move into the spring market, the key question is whether demand will maintain its upward trajectory

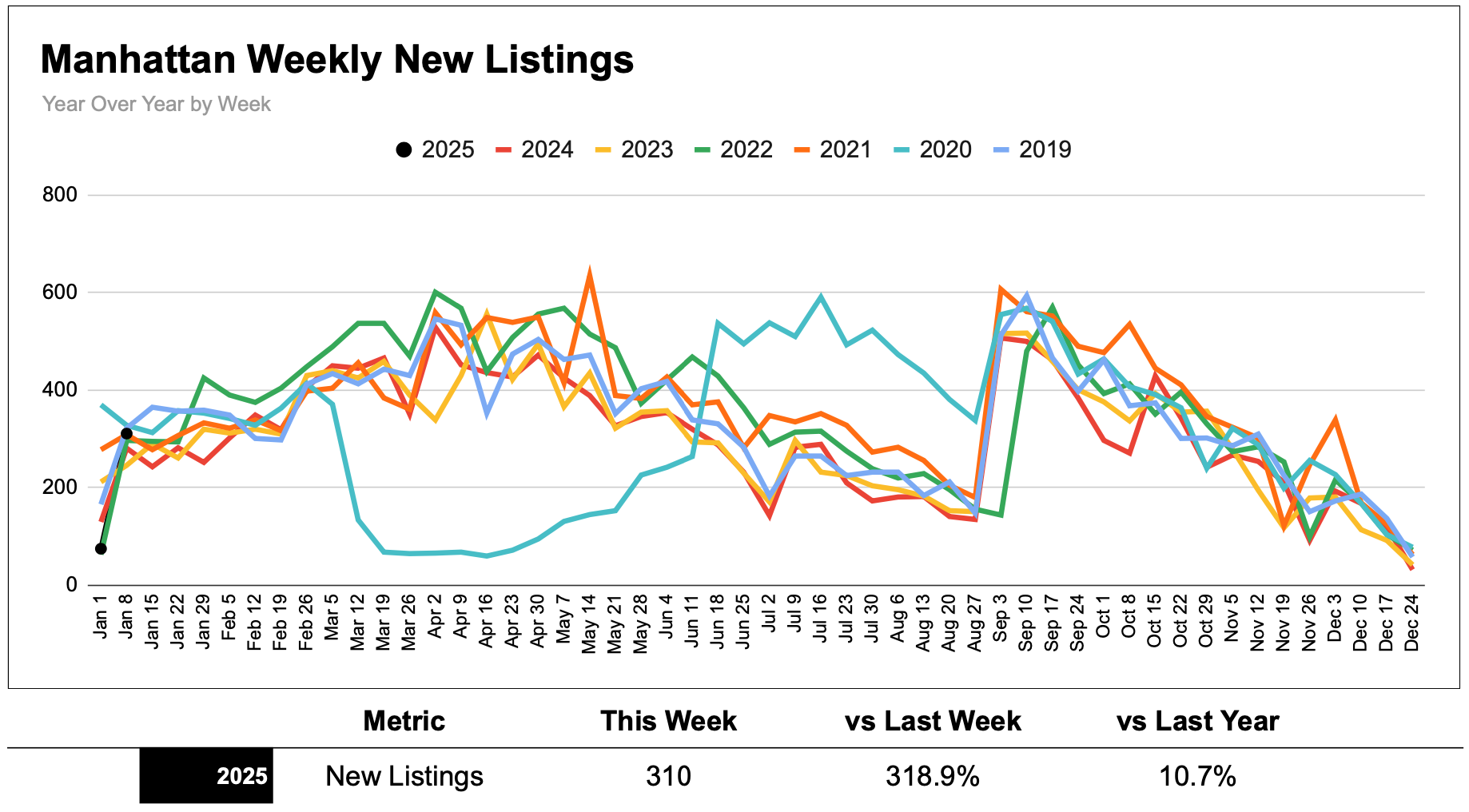

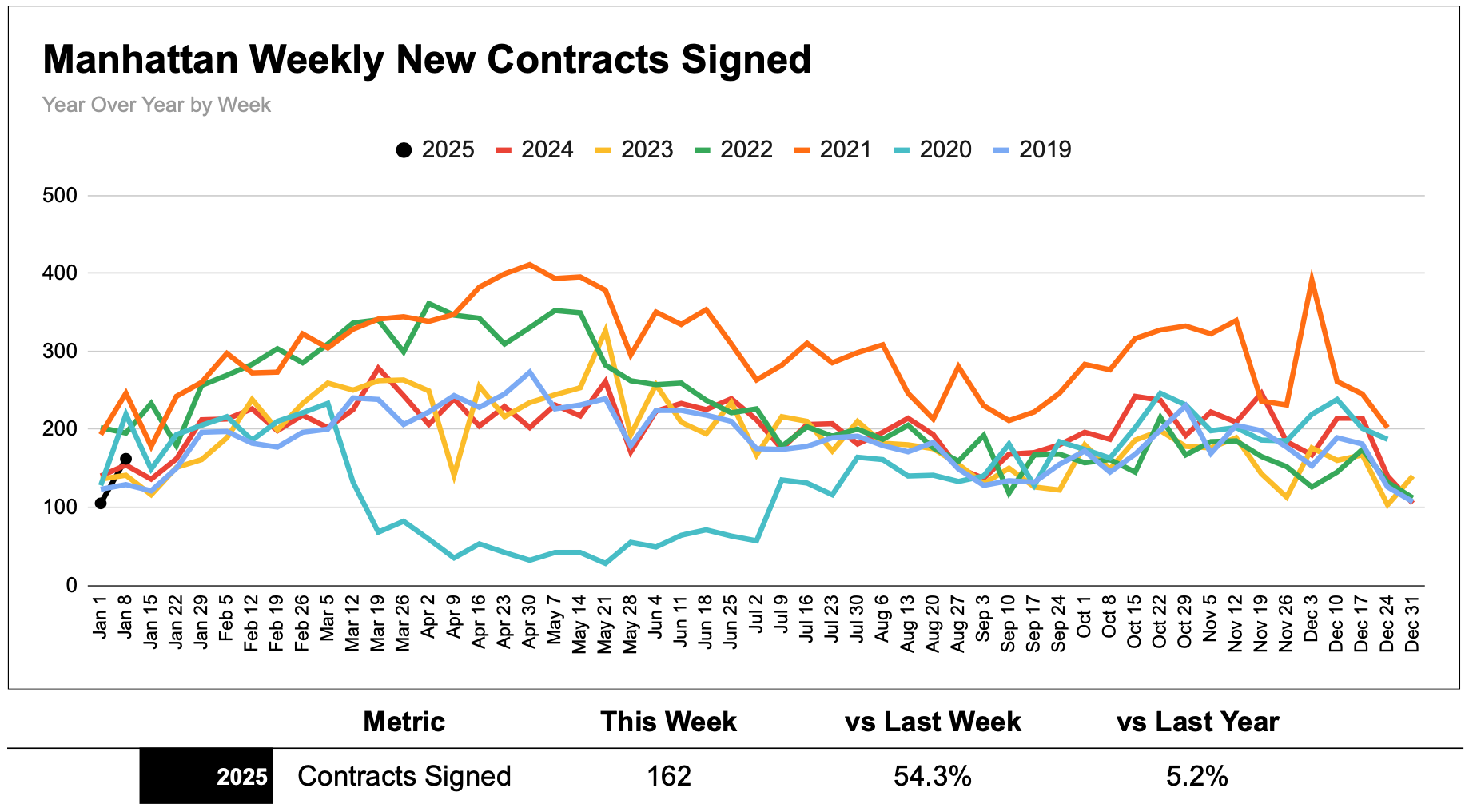

Manhattan Weekly Trends

New listings surged post-holiday, with 304 properties added in the last seven days—a sharp increase following the seasonal slowdown. However, these numbers align with seasonal norms and don’t alleviate the overall inventory tightness.

Contracts signed during the past week reached 160, a 52% increase from the prior week. Although activity remains below the highs seen in 2021, this level is higher than in 2023 and 2022, signaling a steady recovery.

Notes to Sellers and Buyers

Sellers should take note of the shifting dynamics. While inventory is low, some buyers are increasingly discerning. If your property has been on the market for more than 30 days without offers, consider a price adjustment. Acting now, before February, a traditionally slower month, could make all the difference.

For buyers, this is the seasonal low point for demand, and there is the potential that leverage could begin shifting back in your favor. Long-listed properties and recent price reductions present the biggest potential opportunities, especially as sellers aim to make deals before the spring season begins.

Mortgage Rates: A Key Factor

Mortgage rates remain elevated, hovering around 7.14%, with the 10-year yield at 4.74%, its highest level since October 2023. Despite this, Manhattan’s market recovery remains resilient, though rates could influence buyer behavior as we move forward.

Q4 2024 Manhattan Market Report: A Resilient Close to the Year

The final quarter of 2024 showcased Manhattan’s market resilience amid rising mortgage rates and shifting buyer behaviors. While the median sale price dipped 5% from Q3, the average sale price climbed 7%, highlighting continued demand—particularly in the luxury segment, where competition remains tight due to limited inventory.

Properties sold faster this quarter, with median days on market improving by 7%, and sellers retained 95.5% of asking prices, signaling a stabilizing market.

For a detailed breakdown of co-op and condo performance, as well as neighborhood-specific insights, explore the full Q4 Market Report.

With inventory at historic lows and demand gradually picking up, both buyers and sellers need to plan strategically to navigate the current landscape.

We would be happy to have a deeper discussion if real estate is on your mind. Feel free to contact us anytime!