As we navigate through the current dynamics, the New York real estate market is experiencing a nuanced dance of activity, marked by both promising signs and lingering uncertainties. In the past month, there has been a modest uptick in real estate activity, including increased showings and open house attendance compared to early April. However, continuing uncertainty among buyers and sellers has created a market characterized by confusion and a lack of urgency. This has resulted in transactions taking longer to complete.

Here’s a closer look at the recent trends shaping the industry.

Supply & Demand Dynamics:

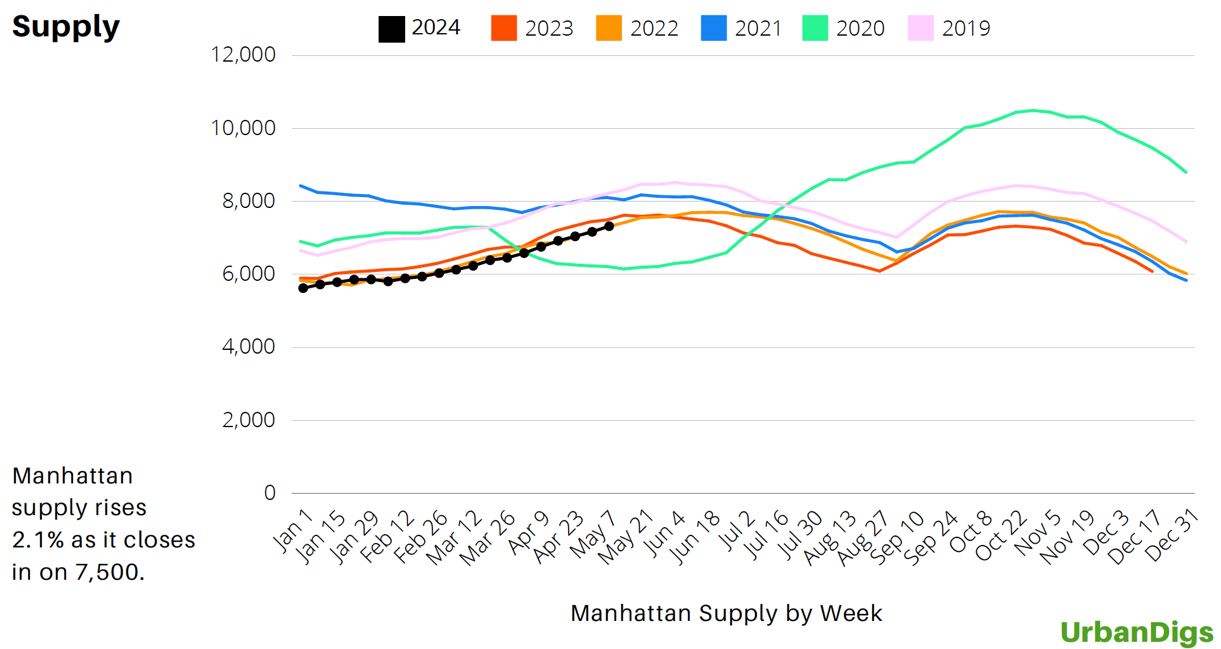

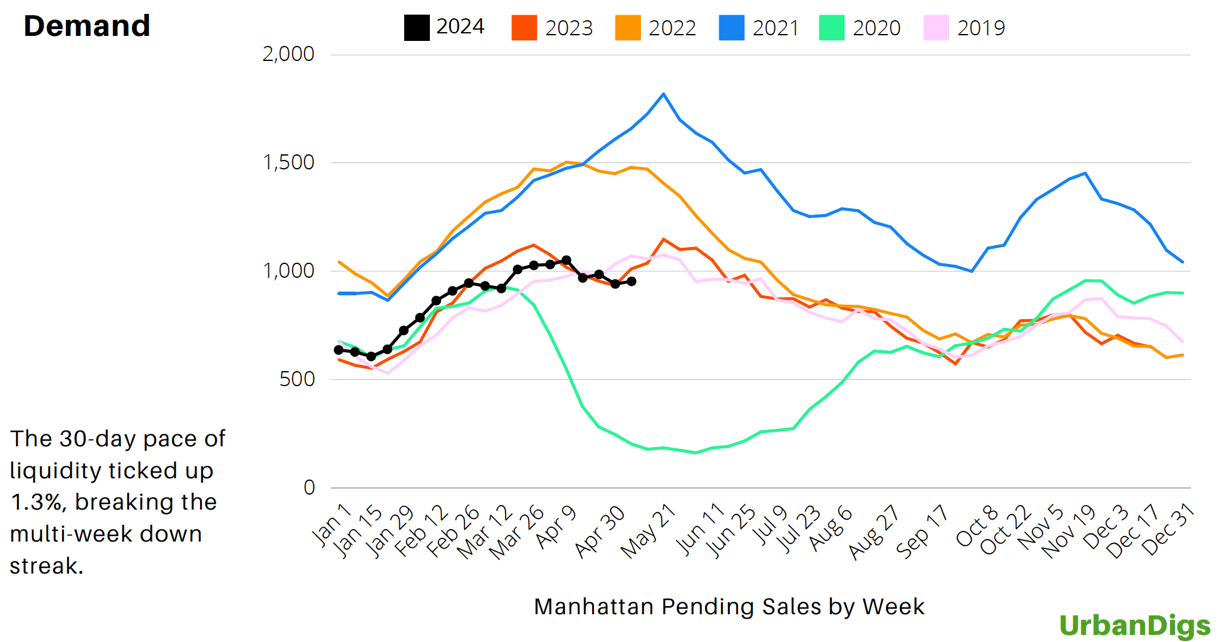

Supply in Manhattan continues its upward trend, nearing the 7,500 mark. However, weekly new listings have started tapering off, signaling a potential shift in supply dynamics. On the demand side, contracts signed have shown a positive bump in recent weeks, suggesting at a potential uptick in activity for May.

Insights:

Despite the uncertainty, new inventory in Manhattan has shown a slight increase, coupled with a faster turnover rate, hinting at a potential peak in activity followed by a possible decline. Net inventory trends have seen a notable uptick compared to last month, albeit slightly down from the previous year, indicating a modest rise in listings.

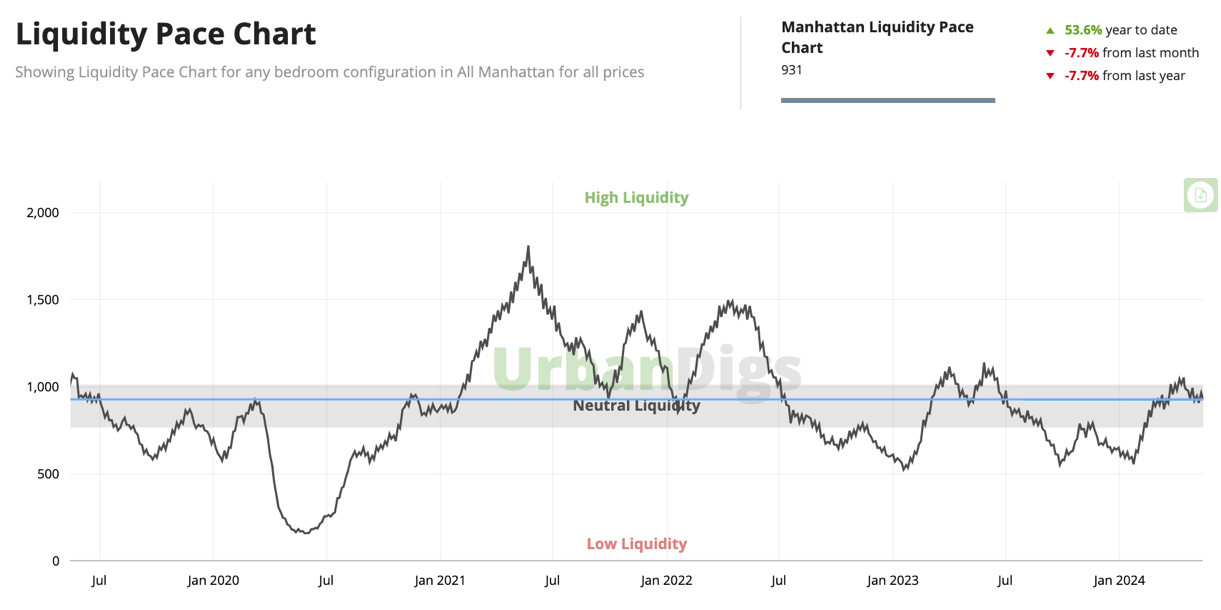

Overall, the liquidity pace has remained stable off of the recovery peak in late January / February. The overall spring market looks like a weaker than usual season.

Contract activity, while somewhat tempered by seasonal factors, remains relatively steady compared to historical averages, showcasing the market’s resilience in navigating current challenges.

The chart illustrates the fluctuation in the market activity over time, using a 30-day moving window of contract activity, where low activity suggests a slow market, aiding in identifying the best times for sellers to list properties or for buyers to submit offers. https://www.urbandigs.com

Market Trends to Watch:

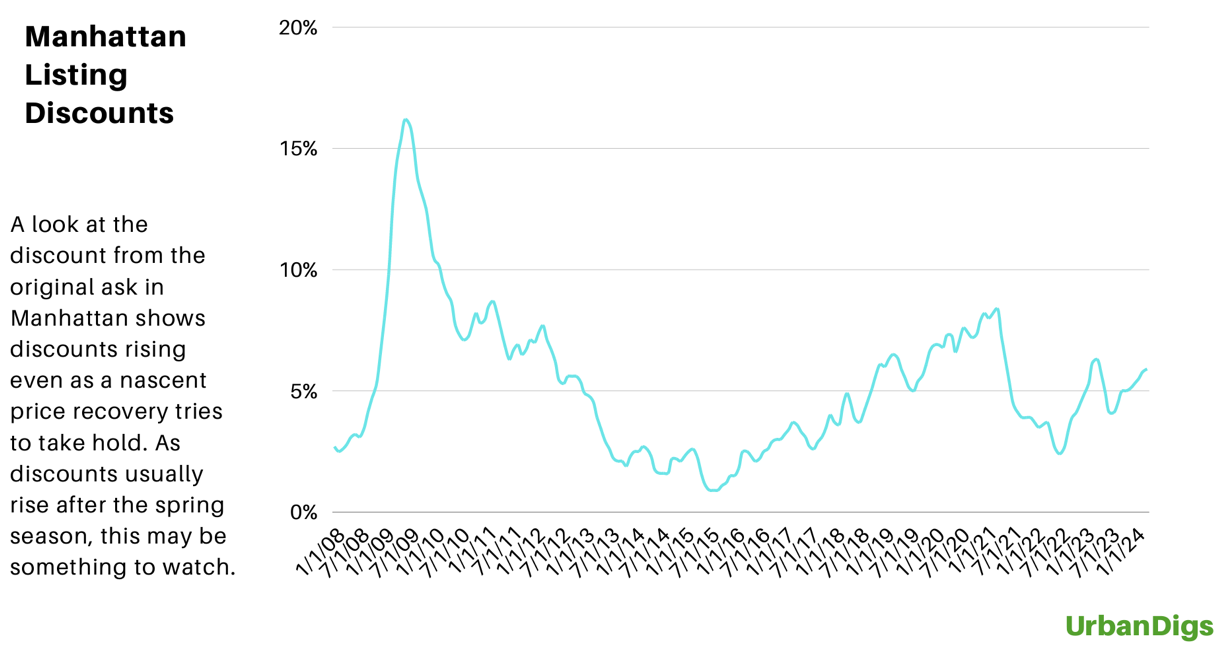

One notable trend is the rising median listing discount, indicating increased negotiability in prices. This comes amidst a recent price recovery, emphasizing the importance of monitoring listing discounts as we transition into the slower summer and fall seasons.

As we move forward, the next five weeks leading up to mid-June will be the tail end of the optimal time to list properties ahead of the summer market.

Interest Rates & Economic Outlook:

Interest rates have stabilized in the new normal range, with no immediate signs of reverting to previous lows. The outlook for interest rate cuts has been pushed out to possibly the end of 2024, reflecting a stable economy, albeit with uncertainties such as upcoming elections and inflation dynamics.

In conclusion, while the real estate market continues to navigate uncertainties, there are signs of resilience and adaptability. As we move forward, staying informed about market dynamics and leveraging optimal listing opportunities will be key to navigating the evolving landscape.

The market continues to evolve, and we remain committed to providing you with timely updates and insights.