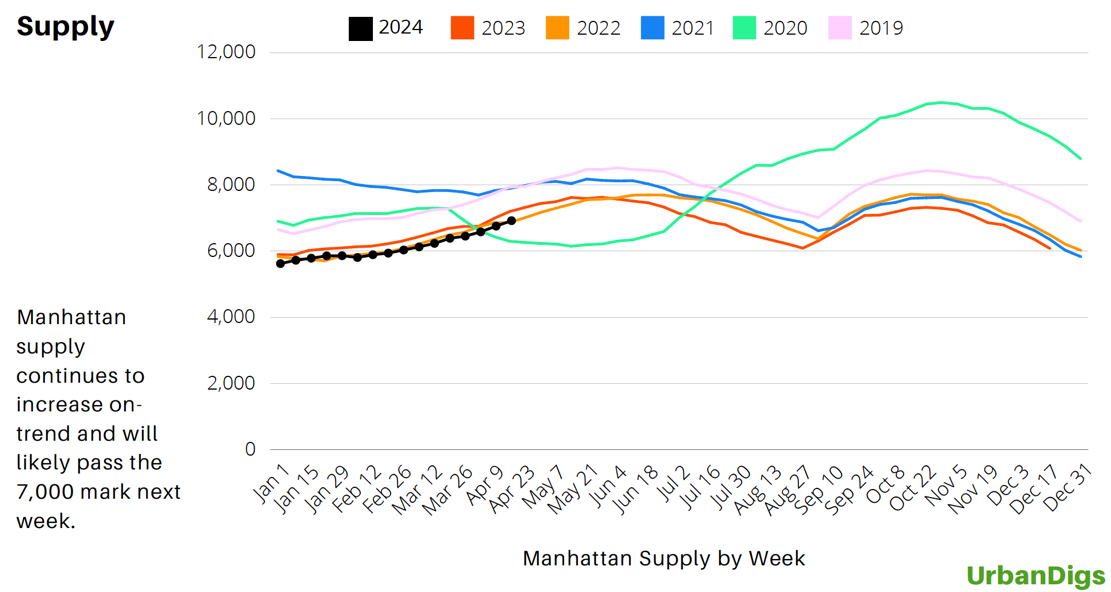

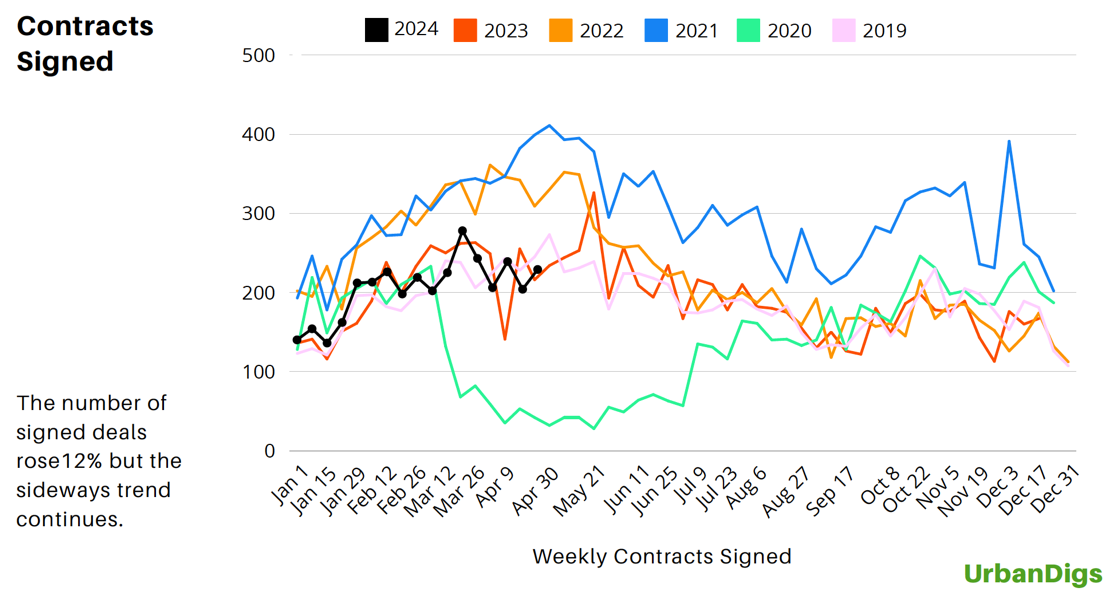

A little bit up and a little bit down. While supply continues to tick slightly higher week over week, demand (contracts signed) is underperforming. This discrepancy between supply and demand paints a nuanced picture of the 2024 spring season, presenting challenges and opportunities for industry participants.

While there is sustained demand and a healthy level of transaction activity, some aspects have fallen short of earlier expectations. One contributing factor is a more cautious approach among buyers, influenced by concerns such as rising interest rates and global economic uncertainties. This cautious sentiment has translated into a slightly longer time on the market for certain properties, particularly in the luxury and high-end segments. Additionally, supply constraints in certain price ranges have limited options for buyers, leading to a more competitive landscape for available properties. Despite these challenges, there are pockets of resilience, especially in desirable neighborhoods and for well-priced properties, showcasing the market’s ability to adapt and evolve amidst changing conditions.

Comparing the Spring Real Estate Market: 2023 vs. 2024:

Let’s put this into perspective. The spring real estate market in 2024 is mimicking 2023 patterns. While there is a buying market, there is a sense of caution among buyers, influenced by factors such as rising mortgage rates and economic uncertainties. As a result, buyers are more discerning and taking their time to make purchasing decisions.

Earlier this year, all eyes were on interest rate cuts potentially beginning in March. Given sticky inflation, the first rate cut, if it even happens, is not expected until December. Until buyers and sellers have a clearer vision on where mortgage rates are going, properties are spending a longer time on the market.

Overall, the spring market in 2024 reflects a maturing phase in the real estate cycle, characterized by cautious buyer participation.

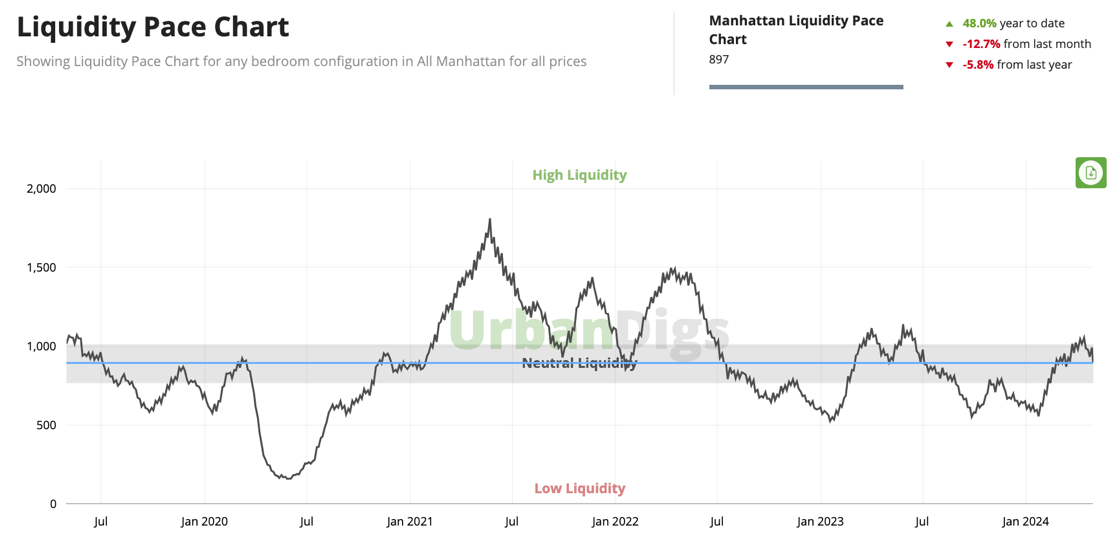

The chart illustrates the fluctuation in the market activity over time, using a 30-day moving window of contract activity, where low activity suggests a slow market, aiding in identifying the best times for sellers to list properties or for buyers to submit offers. https://www.urbandigs.com

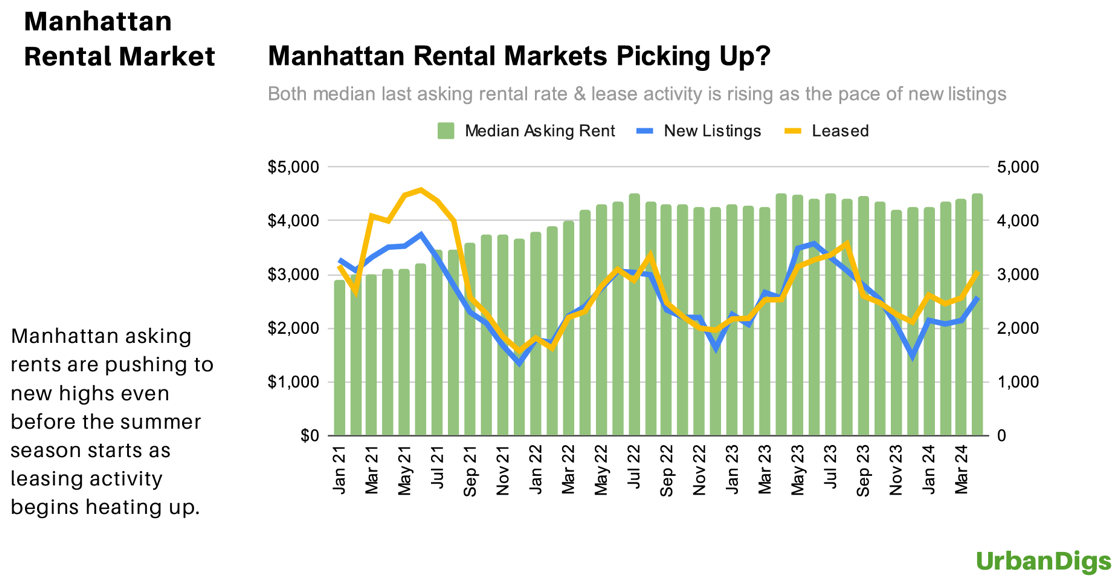

Rental Market is Hot:

Rents are pushing higher. Lease activity is pushing past listing activity creating a tight market for renters as we head toward the busiest time of the rental calendar. From what we are seeing, moving fast is what will be required. If you see something you like, you will have to move fast in order to secure it.

https://www.urbandigs.com

We’re here to provide further insights and answer any questions about the evolving real estate landscape. Feel free to reach out anytime.