The New York City real estate market is a dynamic and ever-changing entity, with neighborhoods that vary from one block to the next. As we delve into the current state of the market, we will focus on two boroughs: Manhattan and Brooklyn.

We will explore the current supply, demand, and trends, shedding light on what both buyers and sellers can expect in the coming months.

Manhattan

The Manhattan real estate market has some interesting dynamics at play. We are in the thick of the fall season with Thanksgiving just around the corner, supply is still lingering. Typically, supply peaks around this time, but the current inventory of 7300+ units is below the usual 7600 level for this season. While this may seem like a sign of strength for sellers, it’s essential to consider the broader picture.

Contracts signed are showing a tiny sign of strength, but it’s still a challenging market. Sellers might perceive this as the strongest point in the market, but buyers have the upper hand with a peak in available units. The supply is expected to decline until the spring of 2024, creating a more balanced environment.

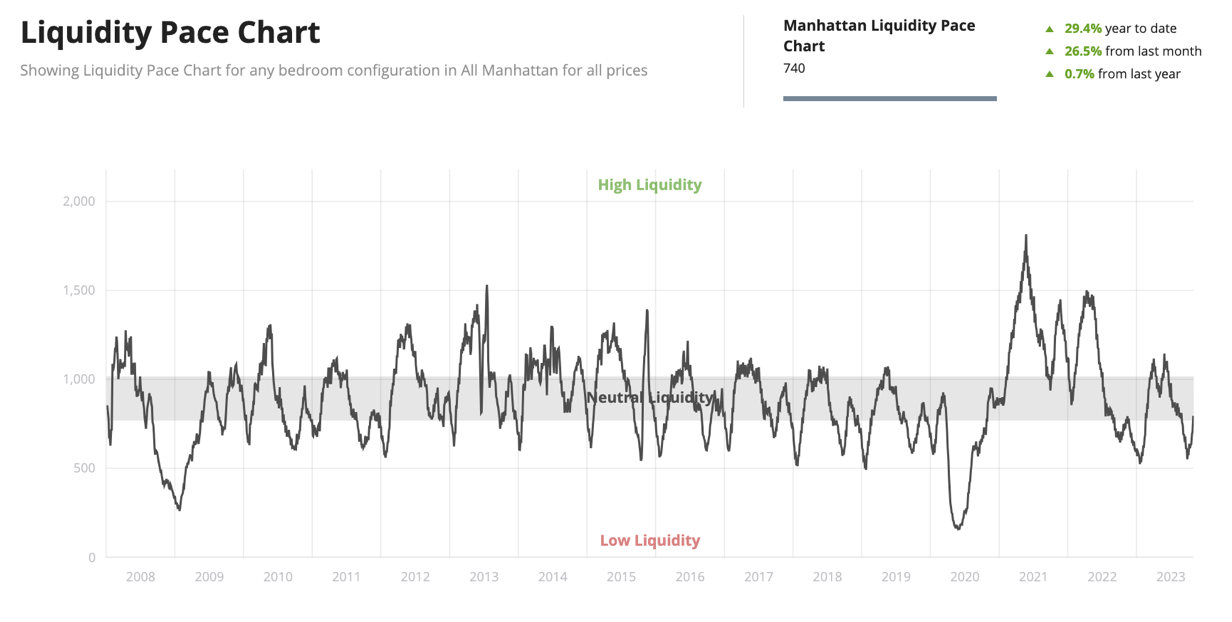

This chart displays a 30 day moving window of contract activity for the selected market. Low liquidity represents a slow market, while High liquidity represents a robust market.

www.UrbanDigs.com

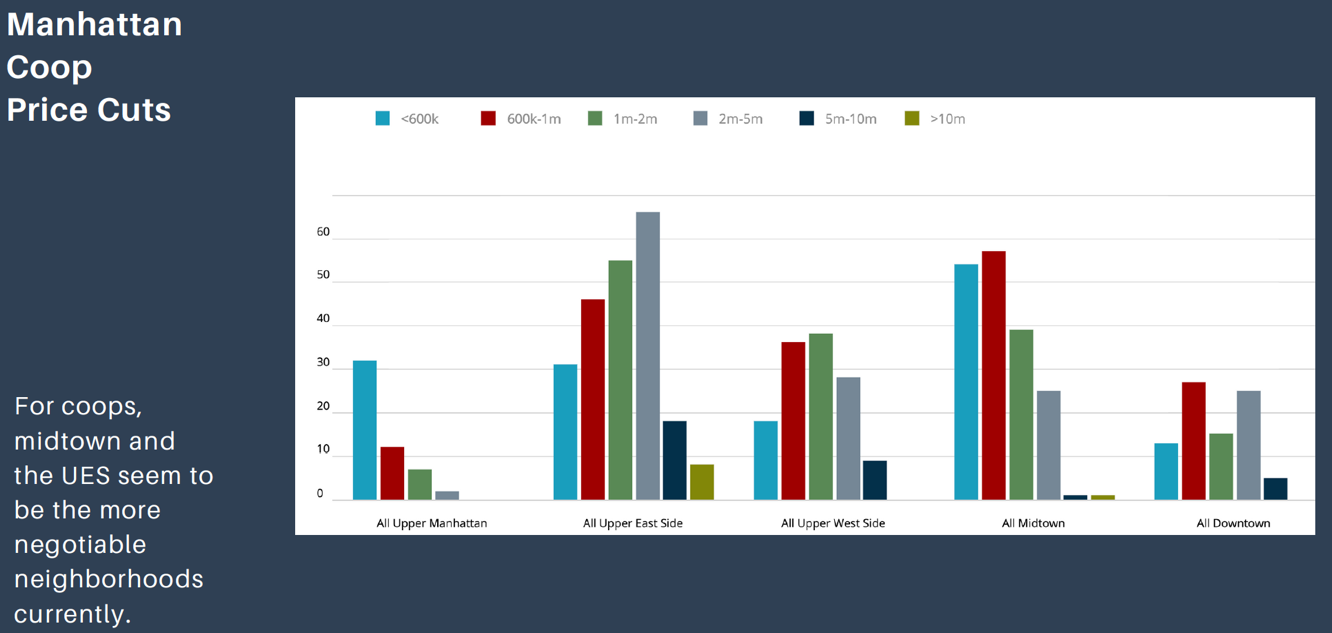

Keep an eye on the liquidity chart, which is showing signs of improvement but hasn’t reached normal levels. Price cuts in coops are concentrated in the Upper East Side and Midtown, making these neighborhoods more negotiable. Condo price cuts are primarily in Midtown, indicating that price action might be rebounding. However, prices have stopped falling but aren’t in full recovery.

www.UrbanDigs.com

The market is trying to strengthen, but we may not see substantial results until the spring.

Brooklyn

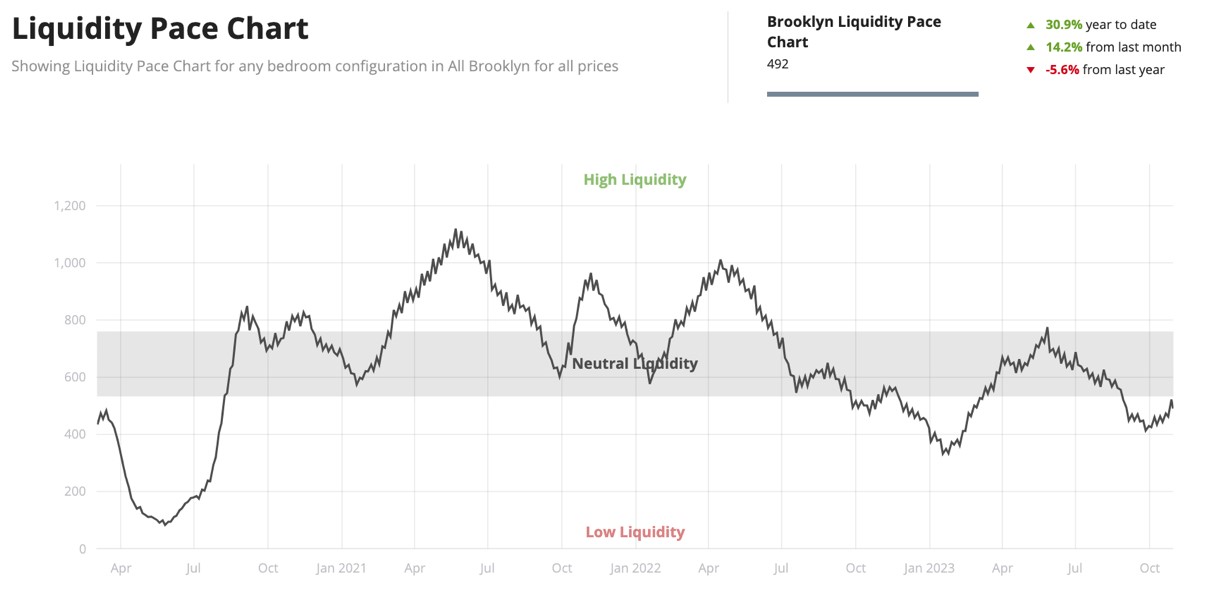

Brooklyn’s real estate market is experiencing similar trends. Supply is peaking, and listing volumes are expected to decline soon. The good news is that contracts signed are finally getting ahead of summer, indicating a sign of strength from 2022.

Brooklyn is currently a buyer’s market, meaning buyers have the upper hand in negotiations. Activity is increasing, but not as aggressively as it should. This presents an opportunity for buyers to act, as sellers may need to be more negotiable in this environment.

This chart displays a 30 day moving window of contract activity for the selected market. Low liquidity represents a slow market, while High liquidity represents a robust market.

www.UrbanDigs.com

Looking Ahead

The residential market in both Manhattan and Brooklyn shows potential for a surprising spring in 2024. The economy is doing well, and if buyers and sellers start transacting, we may see a more active and dynamic real estate landscape. However, it’s essential to keep an eye on the market’s liquidity levels, as they play a crucial role in determining the speed and strength of the recovery.

The New York City real estate market is a complex web of supply and demand, negotiation, and changing economic conditions. As we approach Thanksgiving and the end of the fall selling season, it will be interesting to see how these dynamics evolve. Whether you’re a buyer or a seller, staying informed about the market’s intricacies is essential for success in this ever-changing real estate landscape.