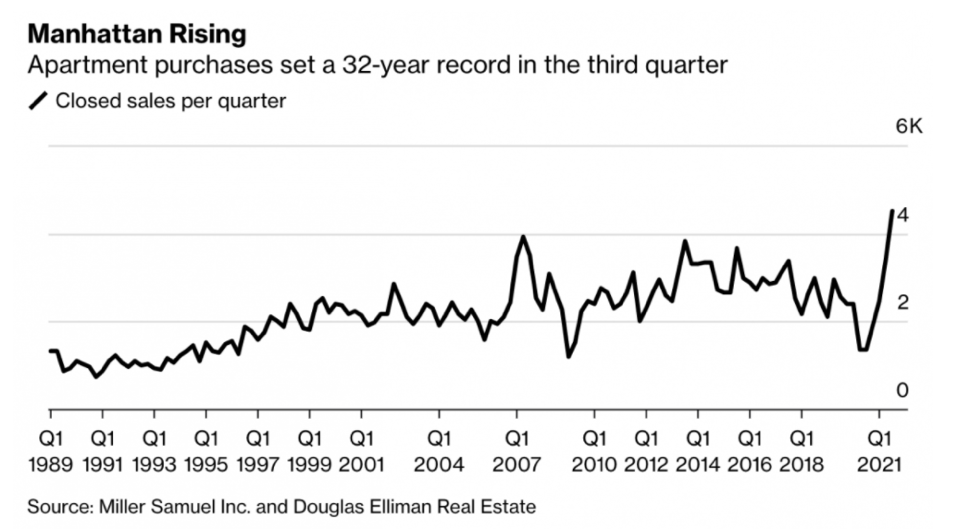

As we’ve been reporting over the last few months, Manhattan’s real estate market has caught fire like never before. The third quarter was also a record summer for sales over $5M – with a luxury market driven by buyers seeking more space and better value. This velocity of deal activity has led to a decline in inventory and fewer active listings, all signs that point to continued strength in the fourth quarter. In total, 2021 is shaping up to be one of the best years yet for Manhattan real estate, and the speed of its comeback has been nothing short of remarkable.

Salad Days

The third quarter was a barnstormer, and you don’t have to look further than this article from the New York Times to get it:

Particular highlights from the article:

- More apartments were sold in Manhattan in the third quarter than at any other time in the last 32 years

- The quarter ended with more than three times as many sales as in the same period in 2020, when the market was largely locked down because of the coronavirus, and with 5 percent more sales than the same time in 2019, before the pandemic.

- Bidding wars are also returning, and the share of all-cash buyers, after falling to a seven-year low of 39.3 percent at the start of the year, is up to 48.6 percent of all sales, in line with the longtime average, Mr. Miller said.

This sentiment was shared industry-wide with big headlines in Bloomberg, Crains, The Real Deal, Mansion Global, though all were of course reporting the same underlying data (so save time and just read the NY Times article).

Jonathan Miller, in his Housing Notes, fills out the picture:

- Sales more than tripled annually to the highest quarterly total in more than thirty-two years

- Listing inventory fell sharply from the prior-year quarter but remained above the third quarter decade average

- The market share of bidding wars rose to its highest level in three years

- Months of supply indicated the pace of the co-op market was the fastest seen in four years

- All co-op price trend indicators moved above the prior-year level and from the same period two years ago

- All condo price trend indicators fell annually, sharply skewed by the drop in average sales square footage

- Condo listing inventory declined from year-ago levels but was consistent with the same period two years ago

- The highest market share of luxury bidding wars in at least five years

- New development sales more than tripled from the prior-year quarter and nearly doubled from the same period two years ago

Less well reported, but of equal significance was the confirmation data coming in from the commercial leasing market, reported on by BISNOW (a commercial real estate focused publication).

Highlights include:

- Manhattan’s had its best quarter since the coronavirus pandemic began over the summer

- Some 7.7M SF was leased between July and September, a 55.8% jump from the previous quarter

- From 2015 to 2019, the Q3 average is roughly 8M SF [of leasing]. We are at 7.7M SF, so we’re not quite at pre-pandemic levels, but it is a good sign.

- Kastle Systems had New York City’s physical office occupancy in the New York metro area at 28.1% on Sept. 15 — the highest that rate has been since the start of the crisis

We like to see this confirmation because residential real estate cannot continue at its torrid pace unless things are picking up in commercial real estate as well – people have to work here to want to live here.

A third kind of confirmation is the experience of living in New York City. Fred Peters, CEO of Warburg put it succinctly when he said: “Sidewalks are crowded, as are buses. Restaurants are buzzing. Broadway, concerts, and the opera play every night to the vaccinated. The city is alive!”

We expect the fourth quarter of 2021 and first quarter of 2022 to be very busy, perhaps down somewhat from the 3rd quarter 2021, but still very active. In past years, pace has been perhaps most influenced by seasonality; in the next 12 months the drivers will be Covid-19 vaccinations and the return to work movement, so expect transactions to happen right up to Christmas Day, and even in the week leading up to New Year’s Day.