Mortgage rates are at an all time low!

Mortgage rates are at historic lows. Whether you are a buyer or currently have a mortgage, check in with your mortgage banker. You never know how much you can save until you ask!

You never know how much you can save until you ask!

As you are contemplating your options, a few things to consider.

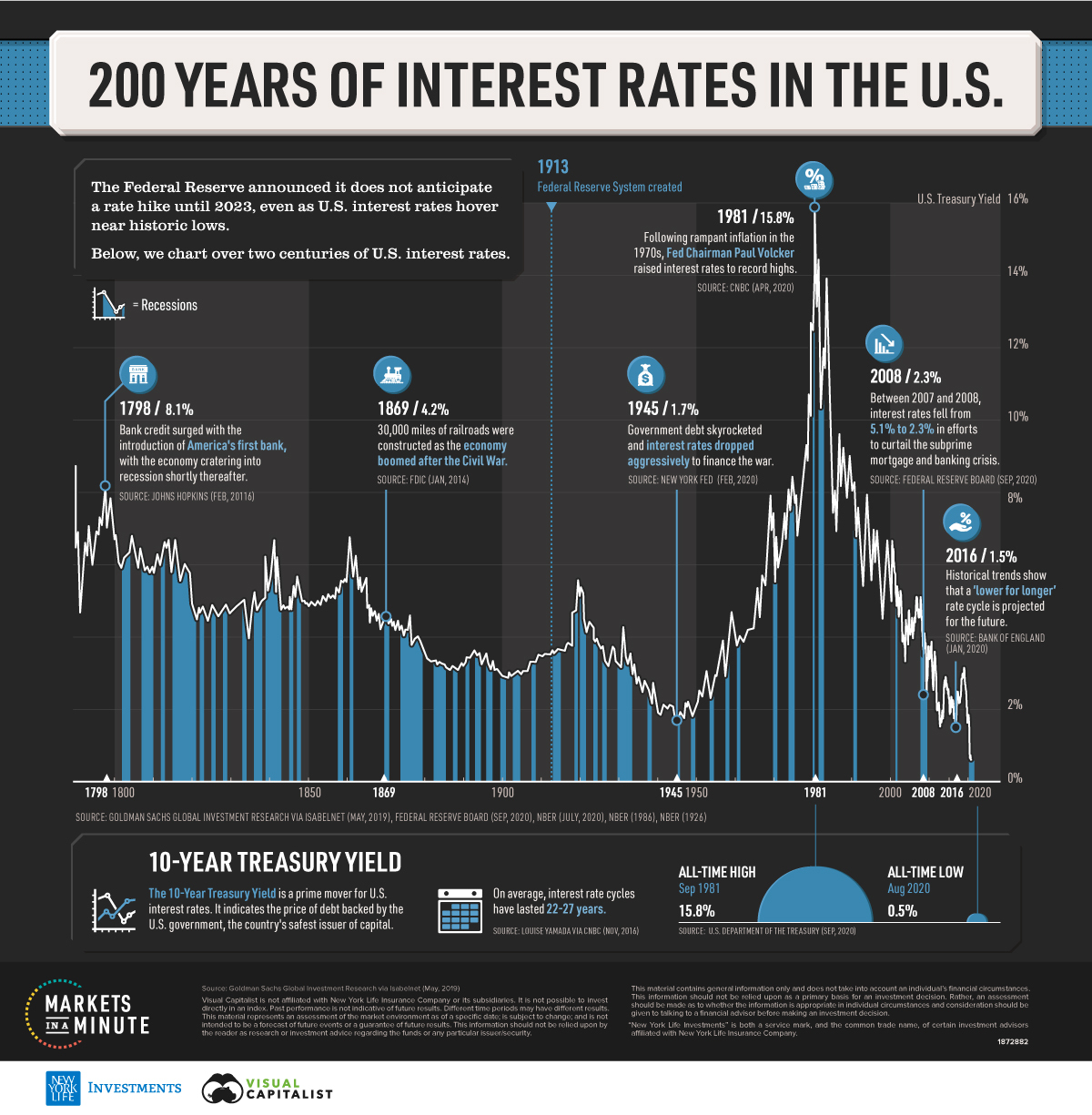

Do mortgage rates go down when the Fed cuts rates?

A Fed rate cut changes the short-term lending rate, but most fixed-rate mortgages are based on long-term rates, which do not fluctuate as much as short-term rates. Generally speaking, when the Fed issues a rate cut, adjustable-rate mortgage (ARM) payments will decrease.

What to consider if you’re shopping for a mortgage

When you’re shopping for a mortgage, compare interest rates and APR, which is the total cost of the mortgage. Some lenders might advertise low interest rates but offset them with high fees, which are reflected in the APR.

If you have a relationship with a lender, bank or credit union, find out what interest rate or customer discount you might qualify for. Often, lenders will work with customers to give them a better deal than they might otherwise get at another place.

Refinancing your mortgage could cost more thanks to an ‘adverse market’ fee

For those considering a refinancing of your existing mortgage, effective December 1st, lenders are required to pay an “adverse market” fee to Fannie Mae and Freddie Mac on each refinanced mortgage sold to those government-sponsored agencies. Not all mortgages are sold to government-sponsored agencies but another good reason to discuss options with your mortgage expert sooner rather than later.

Additional resources:

https://www.bankrate.com/mortgages/federal-reserve-and-mortgage-rates/

https://www.bankrate.com/mortgages/current-interest-rates/

As always, if you have any questions, feel free to contact us anytime!